Article Preview

Translation Key :

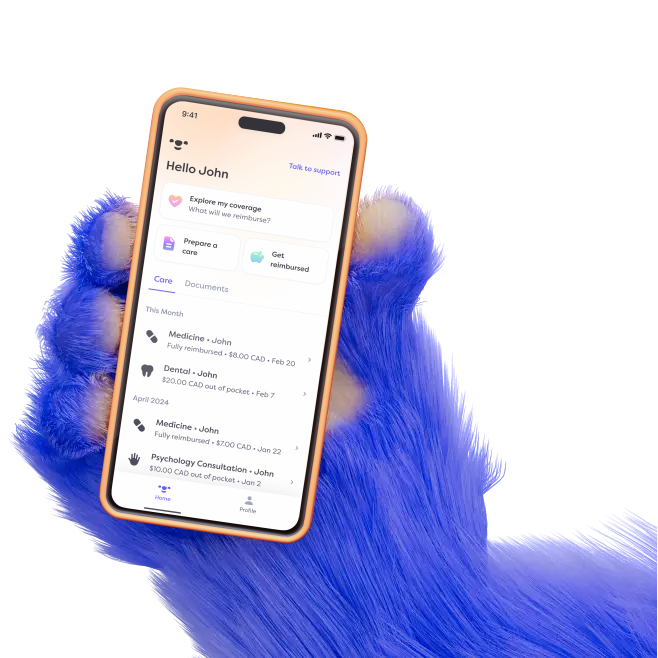

not setModern benefits with Alan

Best group benefits providers in Canada: How to choose + compare options

Choosing group benefits in Canada shouldn’t be this confusing. Some providers are insurers. Some are third-party admins. Some only resell plans.

If you’re a founder, COO, or People lead at a 15–250 person company, chances are you’ve googled something like: “Best group benefits providers in Canada”, “Humi vs SimplyBenefits vs Alan”, “How do I switch from Sun Life?”

This guide gives you an honest breakdown of the main options, what they do well, and where the trade-offs are.

| Provider | Type | Best For | Admin Load | Claims UX | Notes |

|---|---|---|---|---|---|

| Alan | Insurer + Platform | Teams 15–100 wanting one provider for all | Low | Real-time, in-platform | Fully integrated experience |

| Chambers of Commerce Group InsurancePlan | Pooled Plan | Companies under 15 employees | Low | Manual | Predictable pricing, limited flexibility |

| Collage / GroupHEALTH / BBD | Broker-Tech Hybrid | Mid-sized teams | High | Fragmented | Broker model with some tech tools |

| Humi | HR + TPA | Startups already using Humi HR/payroll | Medium | Depends on carrier | Plan sits on partner insurers like Empire, Beneva |

| Manulife / Sun Life / Canada Life | Traditional Insurer | Larger orgs with broker support | High | Legacy portals | Widely used, less transparent |

| SimplyBenefits | Digital TPA | Teams working with brokers | Medium | Partner processes claims | Not a carrier, but cleaner front-end |

Types of providers (and why it matters)

Before comparing options, it helps to know the main models in Canada:

- Traditional Insurers (Manulife, Sun Life, Canada Life): Underwrite and manage their own plans, usually through licensed brokers.

- Third-Party Administrators (TPAs) (Humi, SimplyBenefits): Don’t insure directly. They manage plans from carriers and handle day-to-day admin.

- Pooled Plans (Chambers): Small businesses share risk across a group to stabilize costs. Simple but less flexible.

- Integrated Platforms (Alan): Combine insurer, platform, and support in one. No broker middleman, fewer hand-offs.

Each type has trade-offs around flexibility, speed, transparency, and cost.

Regulation Note: Group benefits in Canada are provincially regulated. Your provider must be licensed in your province (Ontario, Alberta, BC, Quebec). That’s one reason why switching or expanding coverage can vary by region.

Provider Deep Dive

Alan

Type: Integrated Insurer + Platform

- Pros: One provider for plan, tech, and support. Real-time claims. Clear pricing. Low admin load.

- Cons: Newer to Canada, less known than legacy insurers.

- Best For: Teams with 15–100 employees wanting fewer hand-offs and faster support.

Chambers Plan

Type: Pooled Plan

- Pros: Stable costs. Easy onboarding through local brokers. Ideal for smaller teams.

- Cons: Limited customization. Manual claims. Harder to leave.

- Best For: Companies under 15 employees that value predictable pricing.

Collage / GroupHEALTH / BBD

Type: Broker-Tech Hybrid

- Pros: Combines broker guidance with tech for quoting and onboarding.

- Cons: Still involves multiple parties (broker, carrier, TPA). Support can feel fragmented.

- Best For: Mid-sized employers wanting a familiar broker model with some digital tools.

Humi

Type: HR + TPA

- Pros: Strong HR and payroll platform. Easy if you already use Humi.

- Cons: Partners with insurers like Empire or Beneva; experience varies by carrier.

- Best For: Startups and small businesses already on Humi wanting one system for HR + benefits.

Manulife / Sun Life / Canada Life

Type: Traditional Insurers

- Pros: Largest national carriers. Broad coverage and network access.

- Cons: Legacy tech. Pricing is opaque. Admin-heavy onboarding and renewals.

- Best For: Larger organizations with dedicated HR or finance resources.

SimplyBenefits

Type: Digital TPA

- Pros: Modern interface. Integrates with brokers. Fast onboarding.

- Cons: Not a carrier; claims processed by insurer. Limited customization.

- Best For: SMBs with brokers who want a modern user experience.

How to Choose the Right Benefits Provider

- Start with your team size. Small (<15) often means pooled. Mid-size (15–100) can shop between integrated or hybrid.

- Decide if you want a broker. Broker-free means more direct control.

- Ask about claims experience. Some providers still rely on paper or batch claims.

- Compare admin effort. Tools like Alan or SimplyBenefits automate setup and renewals.

- Check licensing. Providers must be approved to sell in your province.

Conclusion

There’s no one-size-fits-all answer for benefits in Canada. The right choice depends on your team size, how much admin work you want, and how you handle HR today.

If you’re unsure, start with a comparison. Upload your current plan to see if you’re overpaying or under-covered. That insight helps you decide between a pooled plan, a TPA, or an integrated provider.

Frequently asked questions

Not always. Traditional insurers work mainly through brokers, but integrated providers like Alan sell directly to employers.

Pooled plans combine many small employers to stabilize rates but limit flexibility. Traditional plans are underwritten per company and allow customization.

Most companies switch at renewal. Review your plan, compare options, and give notice. Providers like Alan can handle switching for you and import existing data.

At 15+ employees, pooled plans often become pricier than custom plans. That’s a good time to review options with an integrated or traditional insurer.

Integrated insurers like Alan handle claims directly in-app. TPAs like SimplyBenefits process claims through their partner insurer.

Updated on 06/10/2025

Published on 06/10/2025

Author

Alan

Canada

Updated on

6 October 2025

The best digital health insurance

Get started with Alan now